HOW TO STOP MILEAGE ON ANY CAR? Best Digital Updates

DeMaio explained that the Mileage Tax is a regressive tax that hurts working families and the lowest income families the most. "It would cost the typical driver between $600 and $900 per year, assuming they drive only 15,000 miles per year," DeMaio noted. "The Mileage Tax would be the death blow to many families, pricing them out of our.

How do I claim for mileage travelled for work purposes? Shoebox.

The federal gasoline tax is 18 cents per gallon, and 24 cents per gallon on diesel fuel, with state taxes averaging 31 cents per gallon and 32 cents per gallon, respectively. That means that, on an average trip to the pump, you're likely paying around 49 cents per gallon in combined state and federal fuel taxes.

Stop! Free Stock Photo Public Domain Pictures

Based on our research, we rate FALSE the claim that a "driving tax" proposed by Biden would cost Americans 8 cents per mile. The $1.2 trillion infrastructure package in Congress would not levy a.

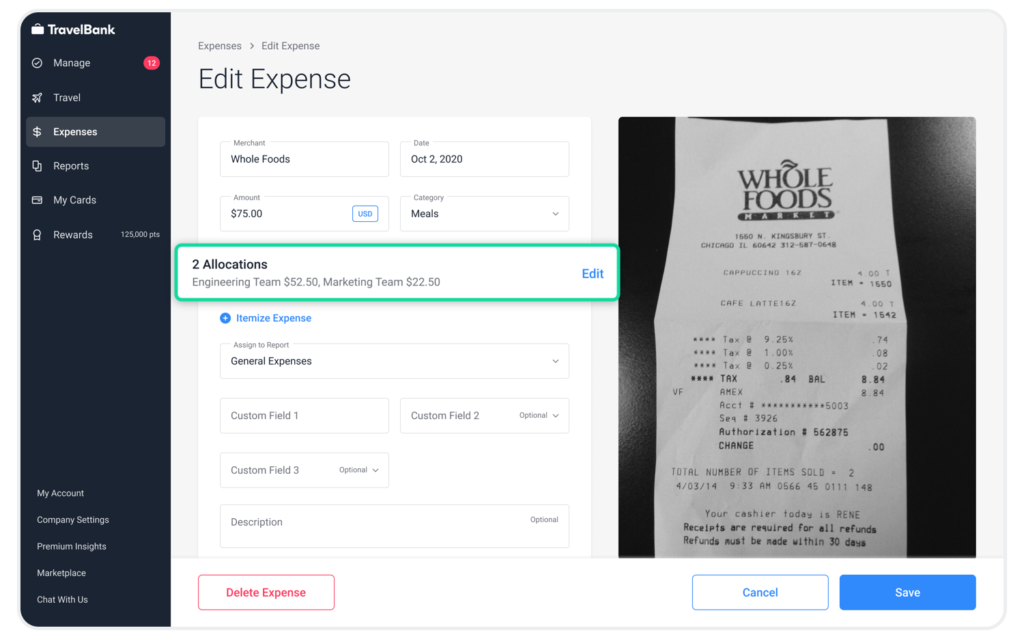

Introducing Expense Allocation and MultiStop Mileage TravelBank

Deduct your self-employed car expenses on: Schedule C (Form 1040), Profit or Loss From Business (Sole Proprietorship) or. Schedule F (Form 1040), Profit or Loss From Farming if you're a farmer. If you're an Armed Forces reservist, a qualified performing artist, or a fee-basis state or local government official, complete Form 2106, Employee.

TAX, TAX, TAX. Buttigieg Says Administration CONSIDERING MILEAGE TAX To Fund Infrastructure

YES: The SANDAG board made the right choice to stop the mileage tax. It would cost most taxpayers between $550 to $800 per year on top of requiring us to pay among the highest tax rates of any state.

Stop the Mileage Tax

For 2023, the federal tax deduction for mileage is 65.5 cents per mile for business use, 22 cents per mile for medical purposes and if you're claiming moving expenses as an active military member.

Introducing Expense Allocation and MultiStop Mileage TravelBank

The Tax Cuts and Jobs Act of 2017 eliminated itemized deductions for unreimbursed mileage and also significantly narrowed the mileage tax deduction for moving expenses. That can now only be.

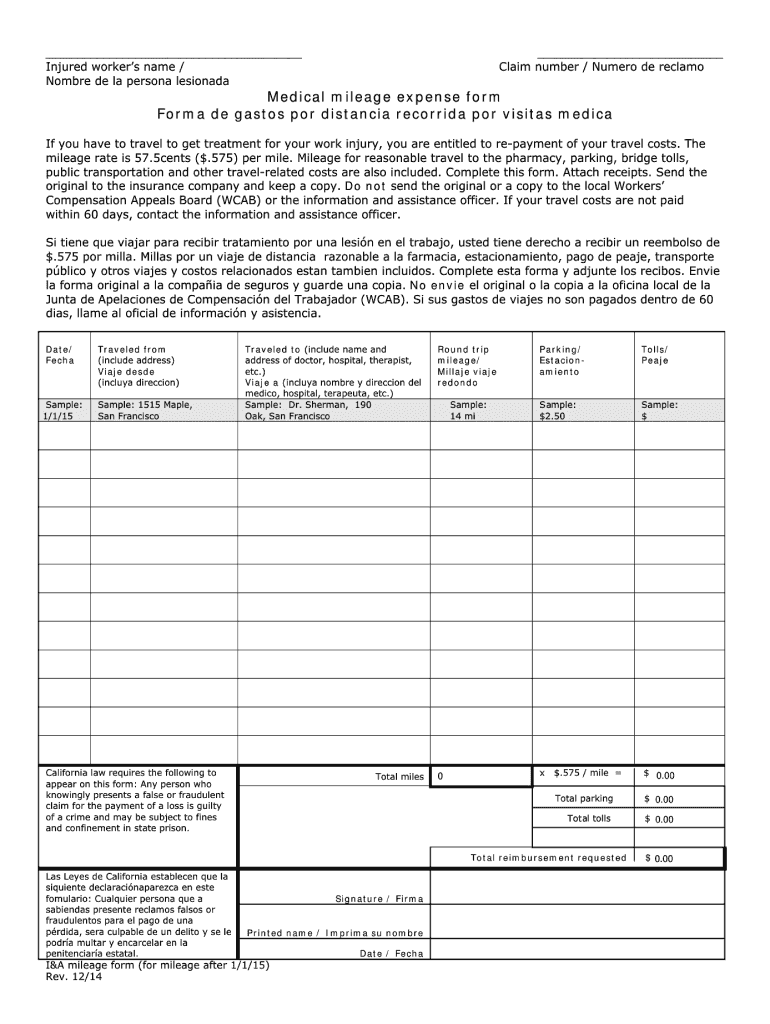

Mileage Form 2021 IRS Mileage Rate 2021

If you drive from your office to a job-related destination—a sales meeting, to get office supplies, or to the airport—those miles are typically deductible. For 2023, the mileage rate is 65.5 cents per mile. This amount increases to 67 cents per mile for 2024. For more information, refer to IRS Publication 463, Travel, Gift, and Car Expenses.

Even Green Drivers Cannot Escape The Road Mileage Tax San Diego News Desk

An IRS rate of 14 cents per mile for mileage relating to work for charitable organizations remained at one rate throughout 2022 since that rate is set by statute, and it will remain at 14 cents a.

Stop The Mileage An Effective Solution To Complex Problems Autoorcar

The California Mileage Tax proposal would require tracking every driver's mileage and charging them four cents per mile they drive. That is the equivalent of an 80-cent-per-gallon hike in the gas tax! The typical California driver will be forced to pay $600-800 a year in higher taxes just to drive on poorly maintained freeways they already.

Vehicle mileage tax is it promising?

If you use the standard mileage rate, your 2023 deduction would be $10,611. 8,100 miles x 65.5 cents = $10,611 for the year; In this case, the standard mileage method gives you the bigger tax benefit. The business-use percentage usually varies from year to year. Operating expenses are annual expenses and do not affect subsequent years.

Vehicle Mileage Tax Proposed to Pay for Infrastructure YouTube

A Mileage Tax - Gas and car taxes are automatically increased every year and now politicians want a tax charge foreach mile you drive!. Online Briefing: The Campaign to Protect Prop 13 and Stop Costly Tax Hikes in 2024.

Everything You Need to Know About Vehicle Mileage Tax Metromile

DeMaio says the best way to stop the new Mileage Tax from taking effect is to do two things. First, vote for state and local politicians in November who are strongly opposed to any new Mileage Taxes. Second, support the California Taxpayer Protection Act that would force a vote on any proposed Mileage Tax before it can be implemented.

FileCanada Stop sign.svg Wikipedia

The Mileage Tax proposal would require tracking every driver's mileage and charging them four cents per mile they drive. That is the equivalent of an 80-cent-per-gallon hike in the gas tax! The typical driver will be forced to pay $600-800 a year in higher taxes just to drive on poorly maintained freeways they already paid for with the.

Stop the Mileage Tax

Dubbed the "Mileage Tax," this proposal would require the constant tracking of drivers' mileage, resulting in an extra four cents per mile or the equivalent of an 80-cent-per-gallon increase in gas tax. This would mean an average annual tax increase of $600-800 per driver. Join the fight to stop this unfair tax and demand that California.

Town Hall Stop the Mileage Tax and Sales Tax Hikes in San Diego County

The mileage tax deduction rules generally allow you to claim $0.655 per mile in 2023 if you are self-employed. You may also be able to claim a tax deduction for mileage in a few other specific circumstances, including if you're an armed forces reservist, qualified performance artist or traveling for charity work or medical reasons. There's.